In line with the 2020 Budget Announcement, Government proposes to broaden the corporate income tax base by restricting the offset of the balance of assessed losses carried forward to 80% of taxable income.

The proposal extends to the balance of assessed losses at the time of implementation, i.e. it is not only the accumulation of losses starting from the date of implementation that will be subject to the new rules. This will contribute to providing the fiscal room for Government to lower the corporate tax rate.

The effect of the proposed restriction is that only companies that would be in a positive taxable income position before setting off the balance of assessed losses will be affected.

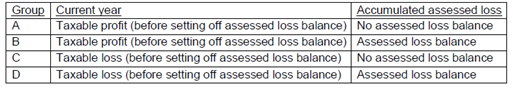

The table below provides an overview of four potential combinations of taxable profit/loss positions combined with whether there is an assessed loss balance or not.

| *Source: National Treasury |

| Those in Groups A, C and D will not be affected by the proposed restriction on assessed losses. It is only companies in Group B that will potentially be affected. Within Group B, if the company’s accumulated assessed loss balance exceeds 80% of its taxable income, the company will be required to pay corporate income tax on 20% of its current-year taxable income.

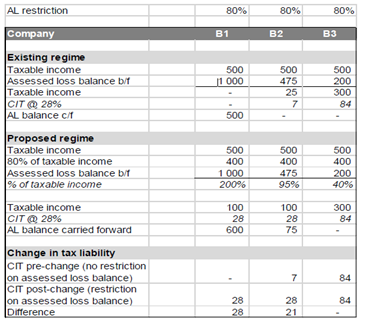

The examples below illustrate how three different companies in Group B could be affected – all of which have years of assessment starting on/after 1 April 2022 and would be in a positive taxable income position before offsetting any prior year losses. Example 1 Company B1 has a year of assessment starting on 1 April 2022. It has R500 of taxable income before offsetting accumulated losses of R1,000. The accumulated loss balance thus exceeds its current-year taxable profit – and, by implication, is more than 80% of taxable income. Company B1 will be required to pay corporate income tax on the portion of its current-year taxable income that exceeds 80% of taxable income (i.e. on 20% of taxable income). As a result, Company B1 will be required to pay CIT of R28 (CIT rate of 28% applied to the taxable income of R100). The remaining balance of the assessed loss can be carried forward to the following year of assessment. Example 2 Company B2 has a year of assessment starting on 1 July 2022. It has a taxable income of R500 prior to setting off assessed losses of R475. The balance constitutes 95% of its current-year taxable income – exceeding the proposed 80% restriction. As a result, Company B2’s assessed loss balance, which can be set off against its taxable income, will be limited to R400 (80% of its taxable income), with the remaining balance of R75 carried forward to future years. Company B2 will also pay CIT of R28 (CIT rate of 28% applied to the taxable income of R100). Example 3 Company B3 has a year of assessment starting on 1 October 2022. It also has a taxable income of R500 before offsetting the assessed loss balance. However, its assessed loss balance is R200, which is less than 80% of its taxable income. Company B3 will be able to use its total assessed loss balance of R200 to reduce its taxable income. |

| *Source: National Treasury |

| This article is a general information sheet and should not be used or relied upon as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your financial adviser for specific and detailed advice. Errors and omissions excepted (E&OE) |