While there are very few tax breaks for individuals, some huge ones are available for retirement funding.

Retirement tax breaks in South Africa are designed to incentivise individuals to save for retirement and provide them with tax relief on contributions to retirement funds. The government has implemented various tax incentives over the years to encourage individuals to save for their retirement and reduce their reliance on the state in retirement.

The tax breaks on offer benefit your contributions, the build-up of your fund, and (to a certain extent) when you draw them down.

Contribution phase:

One of the main retirement tax breaks in South Africa is the tax deductibility of contributions made to retirement funds.

Individuals can claim a tax deduction on contributions to pension, provident, and retirement annuity funds, up to a certain limit. For the 2023/24 tax years, the tax-deductible contribution limit is 27.5% of their taxable income or remuneration or R350 000 per annum, whichever is higher.

However, this does not limit the total amount that you can contribute to your fund. For workplace retirement funds (pension or provident funds), your contributions may be limited by the rules of the particular fund, but for private retirement funds (retirement annuities), there is no upper limit.

All is not lost on the tax front, either. Any contributions that you make that are disallowed as a tax deduction during one particular tax year are carried over to the following tax year. If the following year’s contributions are below the allowable limits for that year, SARS will allow you a deduction of the amounts previously disallowed up to the current year’s limit.

When you get to retirement, if there’s still a portion of your cumulative contributions that had not been allowed as a deduction over the years, this disallowed portion will be added to the amount allowable as the tax-free component of your lump sum.

Build-up phase:

In addition to the tax-deductibility of contributions, retirement funds are also tax-exempt during the accumulation phase. This means that the investment returns earned by the fund are not subject to tax. This tax exemption helps retirement funds to grow at a faster rate, increasing the eventual retirement benefits that individuals will receive.

To understand the power that a retirement fund’s tax-exempt status gives to your investment returns, compare this to what happens to your investment portfolio that is not housed within a tax-exempt ‘wrapper’.

Take a share portfolio, for instance. While most investors would consider shares to be a longer-term investment, very few (if any) would be like one of my former clients who would buy (say) 1 000 shares in Anglo-American, put the share certificate* in a safety deposit box, and leave it there for the next 40 years!

On the contrary, any astute investor would be constantly monitoring their portfolio, selling specific shares and adding other shares when appropriate. This ongoing process of ensuring that the components of the portfolio continue to meet the investment objectives is called ‘rebalancing’.

Unfortunately, every time the investor sells a share in their portfolio, a potential Capital Gains Tax (CGT) liability is triggered even if the proceeds of the sale are reinvested.

Such an investor would have less to re-invest since some of the proceeds would need to be held back to cover the CGT liability. If the full proceeds are reinvested, other shares would need to be sold when the CGT needs to be paid over to SARS which in turn triggers its own CGT liability, and the cycle continues…

This is not the case with an investment portfolio housed within a retirement fund wrapper. In this case, the fund being a tax-exempt entity pays no CGT on sales, Dividends Withholding Tax on dividends, or income tax on interest and rent. Less money for SARS, therefore, means more money for you to reinvest!

* The fact that share transactions have been managed electronically since 1999 gives an indication of how long ago this was!

Preservation phase:

When an individual leaves their employer, they can choose to transfer their retirement fund to their new employer or a preservation fund. Transfers to preservation funds are tax-free and like with any other retirement fund in the build-up phase, the investment returns earned by the preservation fund are also tax-exempt.

The difference between a preservation fund and any other retirement fund is that you would not be able to make additional contributions to a preservation fund it is designed to preserve existing fund benefits.

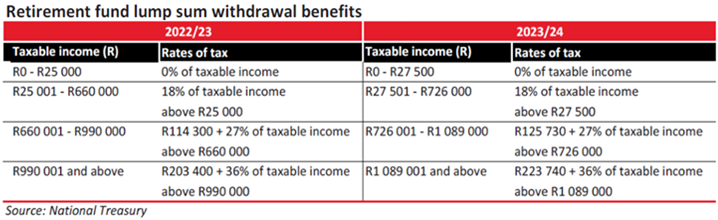

You are entitled to make one withdrawal from a preservation fund before retirement, but this withdrawal will be taxed at the lump sum withdrawal rates (see tables below) rather than the more generous lump sum retirement rates (see tables below).

Employees who retire from their employer may be in a situation where they don’t need to access their retirement funds immediately perhaps due to having other sources of savings or income, or taking up other employment. This gives rise to the question: Is one forced to retire from the fund at the same time as they retire from their employment?

The answer depends on the rules of the fund or their contractual conditions of employment, as there’s no legislative prohibition on transferring their employer retirement fund to another retirement fund whether this is their new employer’s fund, a retirement annuity fund, or a preservation fund.

If such a prohibition does exist, many employees contemplate resigning from their employers in order to facilitate such a transfer, rather than retiring. However, it is important to carefully consider the possible loss of post-retirement benefits (e.g. employer-subsidised medical fund membership) before making one’s decision.

Drawdown phase:

When an individual retires and starts receiving benefits from their retirement fund, these benefits are subject to income tax. However, the government has provided additional tax breaks to retirees to reduce their tax liability.

Historically, pension and provident funds allowed a retiree to take up to one-third of their retirement fund tax-free, while for provident funds the entire fund can be taken as a lump sum.

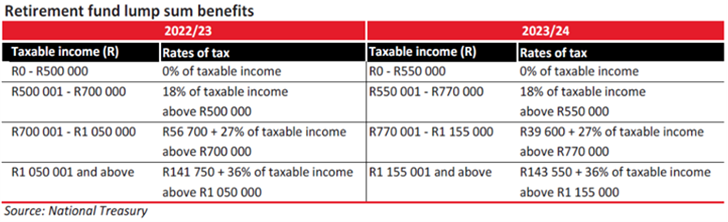

For the 2022/23 tax year, the first R500 000 of the lump sum is tax-free, with the remaining amount taxed according to a retirement tax table (see table below). However, Finance Minister Enoch Godongwana announced in his 2023 Budget speech that this tax-free amount will increase to R550 000 for lump sums accruing on or after 1 March 2023.

Bear in mind that this tax-free amount is a lifetime allowance this means that if you have previously retired from a retirement fund and took a lump sum, or have received a qualifying lump sum gratuity (e.g. due to retrenchment), the tax-free allowance will be reduced by the value of such lump sums on which the allowance was previously claimed.

As far as income is concerned, any retirement fund portion not claimed as a lump sum will need to be used to purchase an annuity or pension. Such payouts will be taxed in the same way as normal income, and PAYE will be deducted where applicable.

The key to reducing the tax payable on such annuity payments is to only draw down as much as you need, and only when you need it. It makes no sense to draw down an annuity, pay the tax on it, and then pay the balance into another investment. Remember, the fund itself is a tax-free entity, so the better option is to leave the money invested in the fund.

Also, chances are that by the time you do need to draw down an annuity, your other taxable income will be far lower (e.g. when you’ve finally decided to retire from the part-time job you took on after you retired from your previous employer), which means that you’ll fall into a lower tax band and thus pay less tax!

WRITTEN BY Steven Jones

Steven Jones is a registered SARS tax practitioner, a practising member of the South African Institute of Professional Accountants, and the editor of Personal Finance and Tax Breaks.

While every reasonable effort is taken to ensure the accuracy and soundness of the contents of this publication, neither the writers of the articles nor the publisher will bear any responsibility for the consequences of any actions based on information or recommendations contained herein. Our material is for informational purposes.